Passing on wealth can be a sensitive subject not only because of the financial complexities but also the family emotions and politics it might drag up. In 2020, Revenues net receipts from Capital Acquisitions Tax (CAT) were €505 million. €430 million of this was made up of Inheritance Tax and €71 million was made up of Gift Tax. Nobody likes to think about what happens after they die but the reality is it’s going to happen to us all. If you want to preserve your legacy for the next generation, you need to prepare.

What is the rate of inheritance tax in Ireland?

How can we ensure that what we have worked all our life to achieve stays in the family or goes to loved ones? Leaving assets to someone other than a spouse or civil partner could mean that they are liable for 33% inheritance tax if the sum is in excess of the threshold. Tax is levied on the total net value of all assets received including the family home, investment properties, cash, life assurance benefits and house contents, jewellery, etc.

What are the tax thresholds?

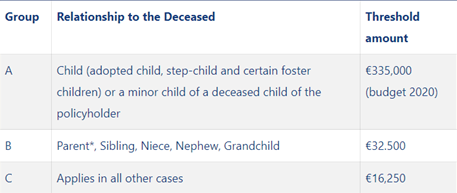

The amount of Inheritance tax you may have will depend on which tax threshold your beneficiaries fall into. The thresholds are the combined tax-free amounts available for both inheritance and gift tax. The table below shows the current CAT thresholds. You are liable to pay 33% on anything above this amount.

*In certain circumstances a parent taking an inheritance from a child can qualify for Group A status. For more information on this see www.revenue.ie/en/tax/cat/index.html

You pay Capital Acquisition Tax/Inheritance Tax on the total of all the gifts or inheritances that you have received throughout your lifetime. To calculate the CAT on the latest benefit/inheritance you need to add all inheritances/gifts received under the same group threshold. All gifts or inheritances from a spouse or civil partner are exempt from this tax in Ireland.

Make a Will

Before you do anything else, make a Will. As part of your planning process make sure you have a current Will in place. It’s one of the most important things you can do to help reduce any inheritance tax liability. A Will ensures that your assets are distributed according to your wishes. More importantly, your family is spared a complicated and drawn-out administration of your estate. This may not be in accordance with your wishes and may result in beneficiaries having to pay more tax than they might otherwise have paid. Also, if you’re not married dying without a Will could leave your partner without any rights or protection.

Get Financial Advice and Review your Assets & Future Needs

The first thing any financial adviser will do is to determine if you have a potential inheritance tax liability and if so how much it will be. After that, it’s a matter of if and how you can reduce it. By looking at your assets such as property, investments, pensions, life policies, business, etc, and taking into account your own future needs, your financial adviser will advise you on how best to plan the most tax-efficient way of passing on your wealth to the next generation.

Family home allowance

You are exempt from Capital Acquisitions Tax (CAT) on the inheritance of a dwelling house if you satisfy certain conditions at the date of the inheritance:

- you lived in the house as your only or main home for the three years immediately before the date of the inheritance

- the house was the only or main home of the person who died (this condition does not apply if you are a dependent relative)

- you do not own or have an interest in another house

- the house continues to be your only or main home for six years after the date of the inheritance. This does not apply if you – are 65 years or over at the date of the inheritance or are required by reason of employment to live elsewhere or are required to live elsewhere because of your mental or physical infirmity and this is certified by a doctor.

- you do not acquire an interest in any other house from the same disponer between the date of the inheritance and the valuation date

Insure your Legacy

If your estate is liable for Inheritance tax then you can avail of Section 72 – Life Assurance relief. This is a life assurance policy, recognised by Revenue. It provides solely for the payment of Inheritance tax, subject to certain conditions. Revenue will not tax the proceeds of the policy if the money is used to pay the inheritance tax arising from the death of the policyholder.

Click here for more on Estate Planning

Transfer to a Surviving Spouse/Civil Partner

Transferring Assets to your Spouse or Civil Partner is not subject to CAT or Stamp Duty.

Partners, who live with each other but are not married or in a civil partnership, have no automatic legal right to each other’s estates. However, under the redress scheme for cohabiting couples introduced by the Civil Partnership and Certain Rights and Obligations of Cohabitants Act 2010 a qualified cohabitant can apply for a share of the estate of a deceased cohabitant.

You can leave some or all of your estate to your partner. However, this does not cancel out the legal rights of a spouse or civil partner if you were married before and didn’t get divorced or had your civil partnership dissolved.

Business Relief

Gifts and inheritances of relevant business property qualify for relief. This can reduce the taxable value of the property by 90% for the purposes of Capital Acquisitions Tax subject to certain conditions. The relief applies to the transfer of a business, a share in a business, or the shares or securities of a company carrying on a business. It doesn’t apply to individual assets, even if the assets were used in the business.

Agricultural Relief

Tax relief applies to gifts and inheritances of agricultural property. This can often reduce the market value of the property by 90% for the purposes of Capital Acquisitions Tax. The property must qualify as agricultural property on both the date of the gift or inheritance and the valuation date. Agricultural property which does not qualify for Agricultural Relief may qualify for Business Relief.

Start a Conversation

Often a health scare, divorce, or life-changing event can prompt people to talk to their loved ones about inheritance issues. Don’t wait for something bad to happen to have the conversation. Why not use the opportunity of a birth in the family, a marriage, or a graduation to evaluate your plans. Talk about how you would like to pass on your wealth. Don’t leave it till it’s too late. Many people who end up paying substantial inheritance tax do so because they didn’t put their financial affairs in order.

Disclaimer

This blog provides general information only. Before making any investment decisions, we recommend talking to a financial planner. They will take into account your particular investment objectives, financial situation, and individual needs. O’Leary Financial Planning and its Authorised Representatives do not accept any liability for any errors or omissions of information.

Revenue figures are correct as of 10/06/2021